Picture this: You’ve just brought home an adorable puppy who brightens your days with tail wags and wet-nosed kisses. Life seems perfect—until one day, your little buddy suddenly needs an expensive vet visit you never expected. Unfortunately, if you haven’t insured your pup yet, that vet bill comes straight out of pocket. Too many dog parents wait until something happens—only to discover their options for coverage are limited, exclusions apply, or premiums have skyrocketed.

When you’re a pet parent, the right timing for insurance can mean the difference between peace of mind and stressful, costly surprises. Pet insurance premiums and coverage options change dramatically with your dog’s age. The younger and healthier your dog is when you enroll, the better off you—and your wallet—will be over their lifetime. Getting your dog covered early means lower monthly costs, better coverage, and the priceless comfort of knowing you can always say “yes” to treatment—no matter what the vet finds.

How Dog Age Affects Insurance Premiums

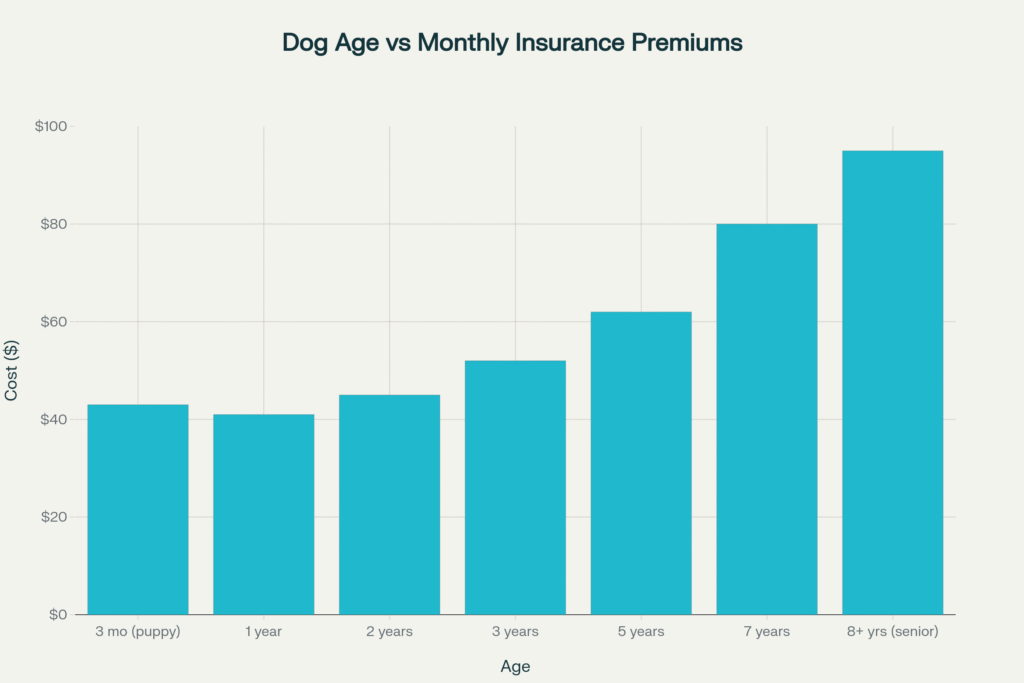

The relationship between your dog’s age and insurance costs is stark and unavoidable. Young puppies command significantly lower premiums because they represent minimal risk to insurance companies. At 3 months old, most healthy puppies have clean medical histories with no pre-existing conditions to exclude from coverage.

Older dogs face substantially higher costs and more exclusions as the risks of illness, injury, and chronic conditions all increase with age. Insurers respond by raising monthly premiums and—more importantly—excluding coverage for any conditions your dog already has before you enroll.

Monthly pet insurance premiums increase significantly as dogs age, with senior dogs costing more than double puppies

The financial impact is significant: A 3-month-old Labrador in the US might cost $30–$45/month to insure, while a 7-year-old Lab could cost $80–$150+/month—and risk denial for any pre-existing conditions. In the UK or Australia, a young puppy’s policy could be less than half the price of a senior dog’s for the same coverage.

What Is the Ideal Age to Get Dog Insurance?

Experts unanimously recommend insuring your dog at 6–12 weeks old, or as soon as possible after bringing them home. Most top providers allow you to start coverage once your pup is 6–8 weeks old, with some accepting enrollment as early as 6 weeks.

Why enroll so early? The advantages are compelling:

- No pre-existing condition exclusions: Any health issues that develop after enrollment are covered for life with most comprehensive plansfursurely+1

- Locks in the lowest possible monthly premium: Early enrollment secures rates that remain competitive throughout your dog’s lifetime

- Secures lifelong comprehensive coverage: Even breed-specific risks that may emerge later are covered if you enroll before symptoms appear

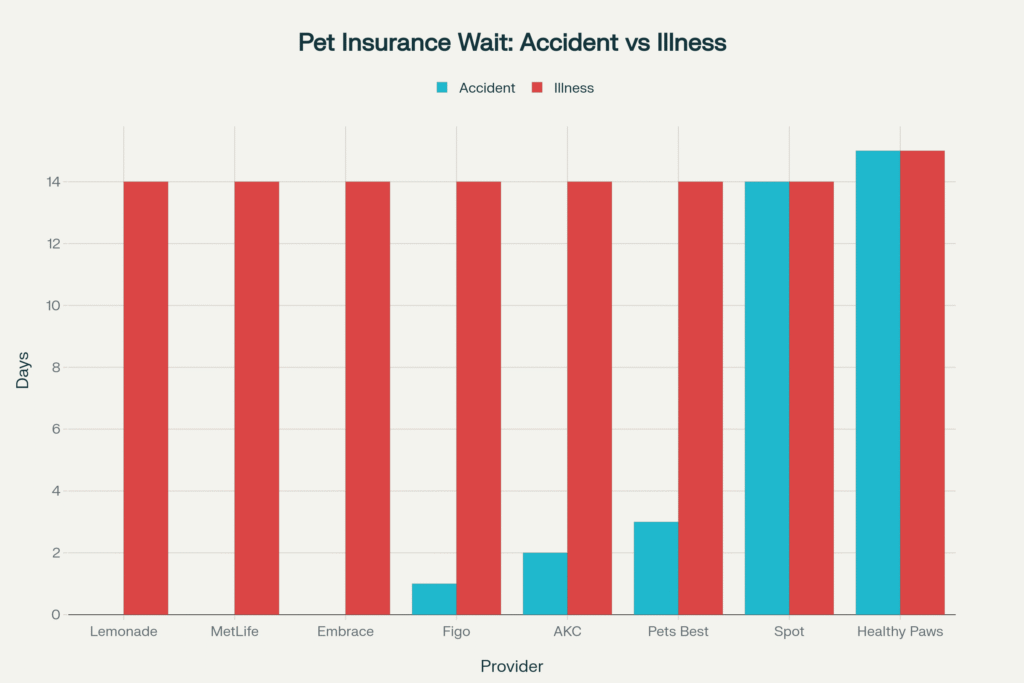

- Maximum protection from day one: Coverage begins immediately for accidents with many providers, and illness coverage starts after brief waiting periods

What Happens If You Wait Too Long?

Delaying coverage carries serious drawbacks that compound over time:

- Dramatically higher monthly premiums: Senior dogs can cost 2-3 times more than puppies for identical coverage

- Extended waiting periods: Some companies impose longer waiting periods for older pets before coverage begins

- No coverage for pre-existing conditions: Any health issues diagnosed before enrollment—no matter how minor—are permanently excluded from coverage

- Age-based enrollment cutoffs: Some insurers set maximum enrollment ages, typically 8–14 years, potentially locking out senior dogs entirely

Most insurers offer immediate or short accident coverage but require 14+ day waiting periods for illness coverage

Best Dog Insurance Plans That Cover Puppies

The top-rated providers for 2025 puppy coverage offer comprehensive protection with competitive rates and favorable terms:

Healthy Paws stands out for unlimited lifetime payouts, lightning-fast claim processing (averaging 2 days), and no annual coverage caps. They accept puppies from 8 weeks and provide comprehensive accident and illness coverage.

Spot Pet Insurance offers exceptional value with no upper age limits for enrollment, highly customizable plans, and up to 90% reimbursement rates. Their policies cover puppies from 8 weeks with flexible deductible options.

Embrace Pet Insurance provides the earliest enrollment at just 6 weeks, wellness rewards programs, and annual coverage up to $30,000. They offer some of the shortest waiting periods in the industry.

Fetch Pet Insurance (formerly Petplan) delivers the most comprehensive coverage available in the US and Canada, including exam fees, prescription medications at 100% reimbursement after deductible, and coverage starting at 6 weeks.

Additional strong contenders include Pets Best (accident-only plans available, 7-week minimum), Figo (global coverage, 1-day accident waiting), ASPCA (behavioral issue coverage), Lemonade (zero-day accident waiting), MetLife (immediate accident coverage), and AKC (unique pre-existing condition coverage after 365 days).

Is It Too Late to Insure an Older Dog?

It’s never truly “too late”—but options become increasingly limited and expensive. While most insurers accept enrollments for dogs at any age (up to their cutoff limits), older dogs face significant disadvantages:

- Much higher premiums: Senior dogs often pay 200-300% more than puppies for identical coverage

- Extensive exclusions: Any conditions in their medical history are permanently excluded from coverage

- Limited plan options: Some older dogs only qualify for accident-only plans, which don’t cover illnesses

Tips for insuring senior dogs:

- Focus on comprehensive plans with lower deductibles to maximize benefit from higher premiums

- Consider accident-only plans if full coverage isn’t available or affordable

- Be completely honest in applications to avoid claim denials

- Research providers that specialize in senior pet coverage

Final Thoughts: Don’t Wait—Insure While They’re Young

The evidence is overwhelming: insuring your puppy as early as possible provides the maximum financial protection at the lowest cost. Early enrollment means you lock in:

- Lower rates for life: Premium increases with age are inevitable, but starting low provides lasting savings

- The broadest possible coverage: No pre-existing conditions to worry about, and breed-specific issues are covered

- Complete peace of mind: You’ll never have to choose between your pet’s health and your financial stability

The bottom line: Don’t leave your best friend’s health to chance. Every week you wait, coverage becomes more expensive and exclusions multiply. The earlier you start, the less you’ll worry tomorrow, and the more you can focus on creating happy memories with your furry companion.

Older dogs are more likely to have existing health issues, which might not be covered by insurance if you delay buying it. This means you could end up paying more out of pocket than expected.

👉 Learn how much pet insurance actually covers in 2025 so you’re not surprised at the vet’s office.