Picture this: It’s 10 PM, and your dog, Max, starts vomiting nonstop. You rush to the emergency vet. After fluids, X-rays, and monitoring—the bill? $1,200. You wonder, “Will insurance cover this?” If you’re asking that in 2025—you’re not alone. Hey, I’ve been there—here’s what I wish I knew sooner about Pet Insurance Coverage in 2025: What’s Really Included?, and what does pet insurance cover in 2025.

As a fellow dog parent who’s navigated the confusing world of pet insurance, I get it. With vet bills rising 60% faster than general inflation and the average emergency visit costing $374 to $1,285, understanding coverage has never been more crucial. The good news? Pet insurance in 2025 is more comprehensive and customizable than ever, with 6.4 million pets now insured and growing. Make sure to explore Pet Insurance Coverage in 2025: What’s Really Included? for more insights.

For detailed information on Pet Insurance Coverage in 2025: What’s Really Included?, make sure to read our comprehensive guide.

What Pet Insurance Typically Covers in 2025

Pet Insurance Coverage in 2025: What’s Really Included?

Most U.S. pet insurers offer Accident & Illness plans that reimburse 70–90% of eligible vet bills after meeting your deductible. Here’s what’s typically covered under standard policies:

“If you’re only worried about accidents, check out our guide on accident-only pet insurance.”

Core Coverage Areas

Accidents & Emergencies

- Broken bones, lacerations, and fractures

- Foreign object ingestion (yes, that includes socks and tennis balls)

- Poisoning from toxic substances

- Bite wounds and cuts

- Car accidents and trauma injuries

Illnesses & Diseases

- Ear infections, UTIs, and skin conditions

- Cancer treatments including chemotherapy

- Chronic conditions like diabetes, arthritis, and heart disease

- Gastrointestinal issues and vomiting

- Hereditary conditions (if diagnosed after enrollment)

Diagnostics & Testing

- X-rays, ultrasounds, and MRIs

- Blood tests, urinalysis, and biopsies

- CT scans and advanced imaging

- Laboratory work for covered conditions

Treatments & Medications

- Prescription medications for covered conditions

- Surgery and hospitalization

- Specialist consultations

- Emergency care and ICU stays

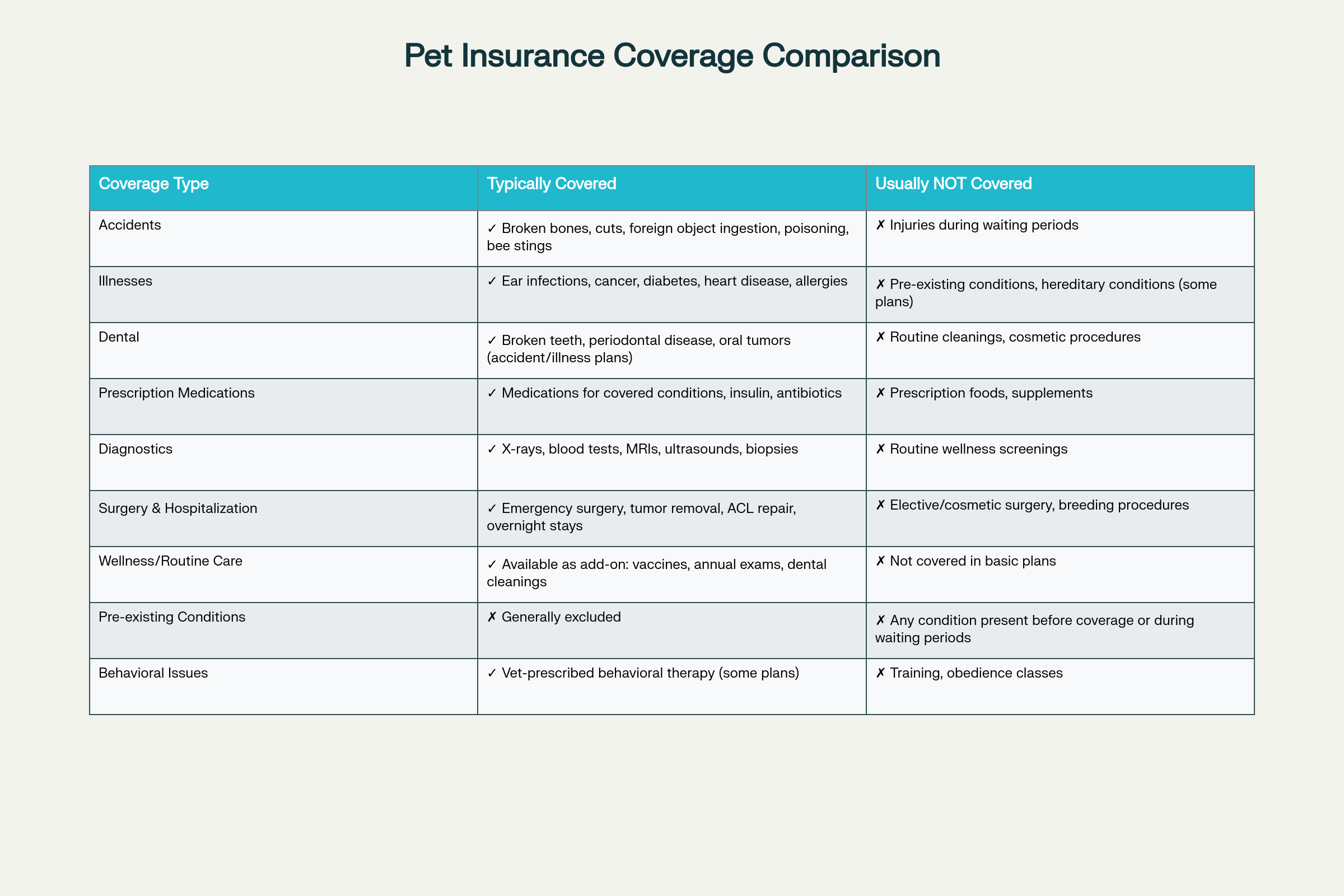

Pet Insurance Coverage Comparison: What’s Typically Covered vs. Not Covered in 2025

What’s Not Covered (The Fine Print)

Understanding exclusions is just as important as knowing what’s covered. Here are the common limitations in 2025:

Universal Exclusions

Pre-existing Conditions

This is the #1 reason claims get denied. Any illness or injury showing symptoms before enrollment or during waiting periods is excluded. Even if your previous vet never officially diagnosed it, insurers review medical records thoroughly

Routine & Wellness Care

Standard policies don’t cover:

- Annual checkups and vaccinations

- Dental cleanings and routine dental car

- Spaying/neutering procedures

- Microchipping and grooming

- Flea/tick prevention medications

Elective & Cosmetic Procedures

- Tail docking, ear cropping, dewclaw removal

- Cosmetic dental work

- Breeding and pregnancy costs

- Non-medically necessary procedures

Behavioral & Training Issues

- Obedience training and behavioral modification

- Training for aggression (unless medically prescribed)

- Boarding and pet-sitting costs

Recent 2025 Updates

The industry is evolving rapidly. Eleven states now have no accident waiting periods, including California, Pennsylvania, and Ohio. This means accident coverage can begin immediately in these states—a significant improvement from previous years.

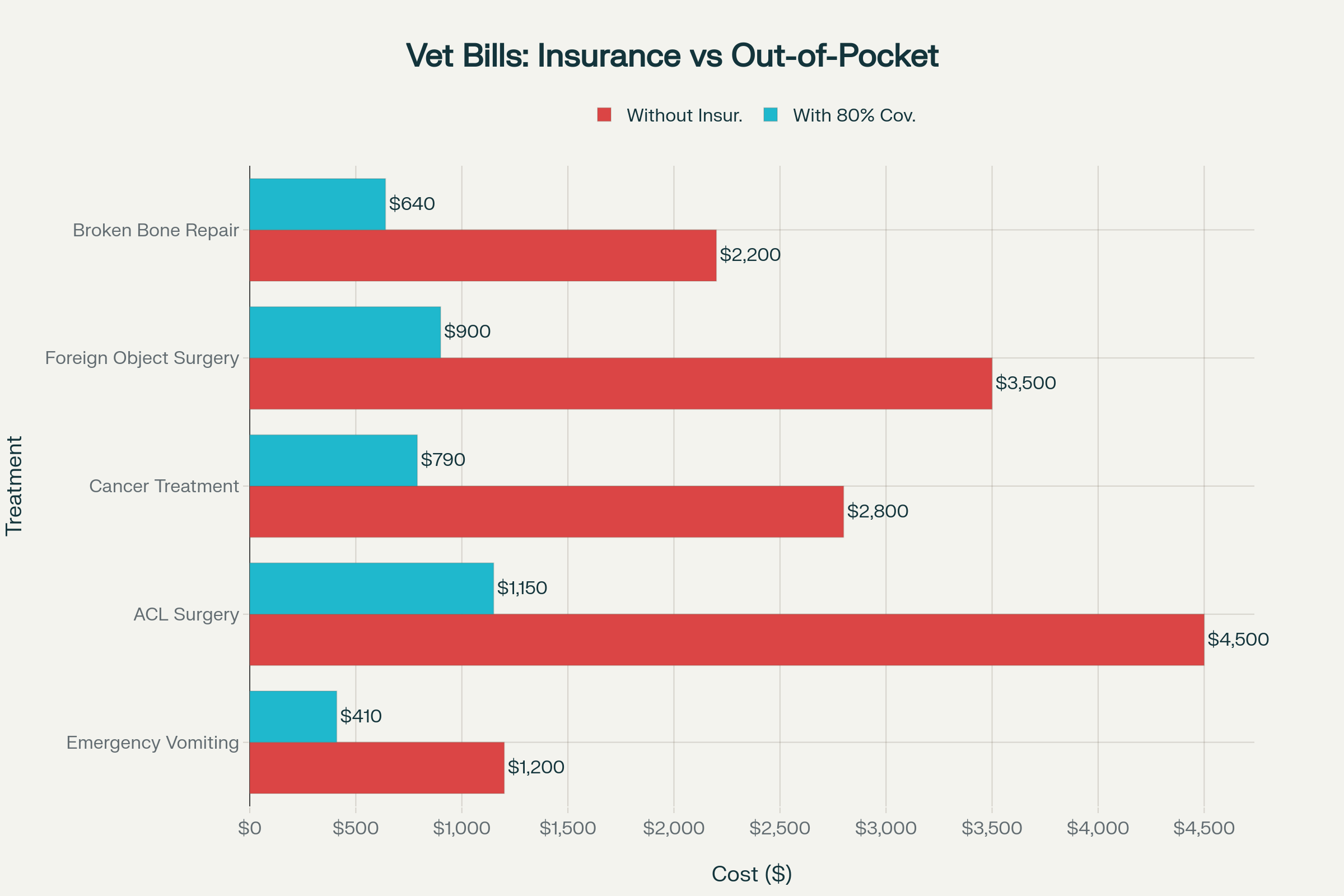

Real-Life Vet Bill Examples (Emergency + Illness)

Let me share some real scenarios that show how insurance can make a difference:

Real Vet Bill Examples: Your Costs With vs. Without Pet Insurance (80% Coverage + $250 Deductible)

Detailed Case Studies

Emergency Vomiting (Max’s Story)

- Total Bill: $1,200 for IV fluids, X-rays, anti-nausea medication, and monitoring

- With 80% Coverage + $250 Deductible: You pay $410 instead of $1,200

- Savings: $790

ACL Surgery (Golden Retriever)

- Total Bill: $4,500 for surgery, anesthesia, post-op care, and pain medication

- With 80% Coverage + $250 Deductible: You pay $1,150 instead of $4,500

- Savings: $3,350

Cancer Treatment (First Session)

- Total Bill: $2,800 for oncology consultation, chemotherapy, and supportive care

- With 80% Coverage + $250 Deductible: You pay $790 instead of $2,800

- Savings: $2,010

Real claim example from 2025: One German Shepherd’s back surgery cost $23,043, with the owner receiving $20,515 back from their 90% reimbursement policy.

Optional Add-ons & Upgrades

The 2025 pet insurance landscape offers more customization than ever. Here are the most valuable add-ons:

Wellness Plans

Starting at $10-20/month, these cover:

- Annual exams ($30-50 coverage)

- Vaccinations ($30-50 coverage)

- Dental cleanings ($100-150 coverage)

- Heartworm prevention ($30-50 coverage)

- Blood work and urinalysis ($25-50 coverage)

Standout Option: Embrace’s Wellness Rewards offers up to $700 annually with ultimate flexibility—you can use funds for grooming, training, supplements, and more.

Dental Coverage

Dental disease affects 90% of pets over age 3. Enhanced dental coverage includes:

- Periodontal disease treatment

- Root canals and crowns

- Oral tumor removal

- Tooth extractions

Note: Basic dental coverage (for accidents/illness) is often included, but routine cleanings require a wellness add-on.

Advanced Coverage Options

- Alternative therapies: Acupuncture, chiropractic, hydrotherapy

- Behavioral therapy: Medically necessary behavioral treatment

- Prescription foods: Some plans now cover therapeutic diets

- Telemedicine: 24/7 virtual vet consultations

Key Takeaways for 2025

Pet insurance has evolved significantly. Here’s what you need to know:

Industry Trends

- Average premiums: $60/month for dogs, $32/month for cats

- Growth rate: 17.97% annually through 2030

- Adoption rate: Still only 4% of pet owners have coverage, but growing 20-29% yearly

Choosing the Right Plan

- Enroll early: Avoid pre-existing condition exclusions

- Consider breed-specific risks: Some breeds have longer waiting periods for hereditary conditions

- Compare waiting periods: Range from 0-14 days for accidents, 14-30 days for illness

- Review reimbursement rates: Options from 50-100% available

2025 Innovations

- AI-powered claims processing for faster approvals

- Customizable modular plans from providers like Nationwide

- Telemedicine integration becoming standard

- Multi-pet family discounts up to 10%

FAQs About Pet Insurance Coverage in 2025

Is breed really a factor in coverage and cost?

Absolutely. French Bulldogs average $92/month while Goldendoodles cost $44/month. Certain breeds face longer waiting periods (6-12 months) for conditions like hip dysplasia.

How long are waiting periods in 2025?

- Accidents: 0-3 days (11 states have no waiting period)

- Illnesses: 14-30 days

- Orthopedic conditions: 6-12 months in some states

Can I use any veterinarian?

Yes! Most U.S. insurers have no network restrictions—you can visit any licensed vet and submit claims for reimbursement.

What about dental coverage?

Accident-related dental injuries are covered under standard plans. Routine cleanings require a wellness add-on. Periodontal disease coverage varies by provider.

How do I file a claim in 2025?

Most insurers now offer mobile apps with photo claim submission. Average processing times range from 2-5 days for top providers. Some offer direct vet payment options.

“Explore more helpful guides on pet insurance at FurSurely.”

Making the Right Choice for Your Pet

Pet insurance in 2025 isn’t one-size-fits-all, and that’s actually great news. With customizable plans, faster claims processing, and more coverage options than ever, there’s likely a plan that fits both your pet’s needs and your budget.

The key is starting early—before that 10 PM emergency vet visit happens. Because when you’re holding your sick pet, the last thing you want to worry about is whether you can afford their care.

Ready to stop worrying about surprise vet bills? Compare personalized pet insurance plans and find coverage that gives you peace of mind. Your future self (and your wallet) will thank you when the unexpected happens. 🐾

Pingback: Pet Insurance vs Savings: What's Smarter in 2025?

Pingback: Best Age to Get Dog Insurance in 2025 (Expert Guide)

Pingback: Top 7 Pet Insurance Plans for Dogs in the USA ( 2025 Update)

Pingback: What Is a Good Deductible for Pet Insurance in 2025?

Pingback: How to Save on Pet Insurance in 2025 – 7 Easy Tips

Pingback: Why Employers Are Offering Pet Insurance Benefits in 2025