Pet parents across the United States face a common financial dilemma: With veterinary costs rising by over 60% in the past decade and the average pet insurance premium now at $52 per month for dogs and $28 for cats, this decision has never been more critical for your wallet—and your pet’s wellbeing.

The stakes are higher than ever. According to recent data, 37% of pet owners ended up in debt in 2024 alone due to unexpected veterinary bills, with nearly 70% of those cases stemming from medical emergencies. When a life-threatening crisis strikes with a $5,000 price tag, over half of pet parents resort to high-interest credit cards just to save their furry family member.

What Is Pet Insurance?

Pet insurance operates similarly to your car insurance—it’s designed to hedge risk rather than cover routine maintenance. You pay monthly premiums ranging from $17 to $277 for dogs and $11 to $90 for cats, depending on your pet’s breed, age, and your location.

The system is straightforward: you pay the veterinary bill upfront, then submit a claim for reimbursement. Most policies reimburse 70% to 90% of covered expenses after you meet your deductible. Unlike human health insurance, pet insurance doesn’t typically cover pre-existing conditions, making early enrollment crucial for maximum protection.

Not sure how much pet insurance actually pays out? Before choosing between a savings account and insurance, see how much of your vet bill pet insurance really covers in 2025.

Coverage typically includes:

- Accidents and injuries

- Illnesses and diseases

- Emergency surgeries

- Diagnostic tests and imaging

- Prescription medications

- Hospitalization costs

Common exclusions:

- Pre-existing conditions

- Routine wellness care (unless you add a wellness rider)

- Cosmetic procedures

- Breeding-related expenses

What Is a Pet Emergency Savings Account?

A pet emergency savings account is exactly what it sounds like—a dedicated fund you build monthly to cover unexpected veterinary expenses. Some pet parents use it exclusively for emergencies, while others tap into it for routine care as well.

The concept is simple: set aside a fixed amount each month (typically matching what you’d pay for insurance premiums) into a high-yield savings account. The money earns interest and remains completely under your control. You can access it immediately without claim forms, waiting periods, or coverage restrictions.

Key characteristics:

- Complete flexibility in usage

- No monthly premiums or deductibles

- Earns interest over time

- Can be used for any pet-related expense

- No coverage limitations or exclusions

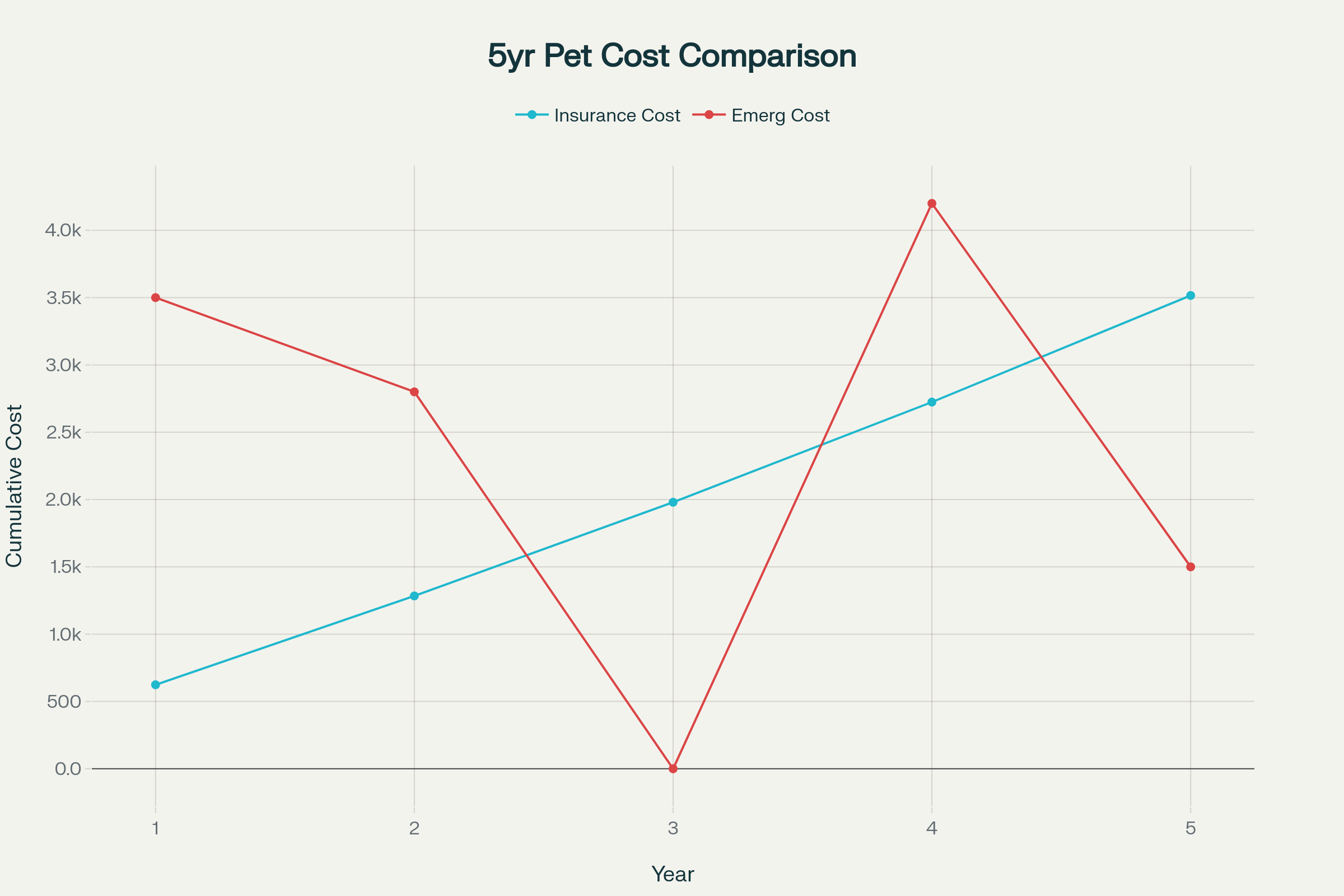

Cost Comparison: Insurance vs Savings Over 5 Years

5-year cost comparison: Pet Insurance vs Emergency Savings Account scenarios

Let’s examine a realistic scenario for a typical dog owner over five years, accounting for average premium increases and common emergency situations:

| Year | Insurance Premium | Cumulative Premium Cost | Emergency Scenario | Out-of-Pocket with Insurance | Full Cost Without Insurance |

|---|---|---|---|---|---|

| 1 | $624 | $624 | Foreign object surgery | $700 (20% of $3,500) | $3,500 |

| 2 | $660 | $1,284 | Allergic reaction | $560 (20% of $2,800) | $2,800 |

| 3 | $696 | $1,980 | No emergencies | $0 | $0 |

| 4 | $744 | $2,724 | Cancer treatment | $840 (20% of $4,200) | $4,200 |

| 5 | $792 | $3,516 | Minor injury | $300 (20% of $1,500) | $1,500 |

Five-year totals:

- Pet insurance: $5,916 (premiums + out-of-pocket costs)

- Savings account: $12,000 (full emergency costs)

- Potential savings with insurance: $6,084

This analysis reveals that pet insurance could save you over $6,000 in this scenario, but the actual savings depend entirely on what health issues your pet encounters.

Which Option Covers Unexpected Emergencies Better?

Timing is everything when it comes to pet emergencies. A savings account requires time to build, potentially leaving you vulnerable during your pet’s early years. Consider this: if you save $100 monthly, you’ll only have $1,200 after one year—insufficient for most major emergencies.

Meanwhile, pet insurance provides immediate coverage (after any waiting periods, typically 2-14 days for accidents and 14-30 days for illnesses). Your puppy could require $5,000 surgery in month two, and insurance would cover 80-90% of that cost.

Emergency costs that could drain a new savings account:

- Foreign object removal: $3,000-$6,000+

- Cancer treatment: $3,000-$10,000 annuallypetbusinessprofessor

- Cruciate ligament repair: $3,000-$6,000india-briefing

- Bloat surgery: $3,500-$7,000pawlicy

- Hit by car trauma: $2,000-$15,000

The unpredictability factor heavily favors insurance. According to veterinary data, pets don’t wait for their savings to mature before getting sick or injured.

Pros and Cons of Pet Insurance

Pros:

- Immediate coverage after waiting periods

- Predictable monthly costs for budgeting

- Large claim protection (some claims exceed $70,000)

- Access to advanced treatments without financial strain

- Peace of mind during emergencies

- No money management required—claims are processed automatically

Cons:

- Monthly premiums whether you use it or not

- Doesn’t cover pre-existing conditions

- Deductibles and co-pays still required

- Premium increases as pets age

- Waiting periods for new policies

- Coverage exclusions vary by provider

Pros and Cons of Pet Savings Account

Pros:

- Complete flexibility—use for any pet expense

- Earns interest over time

- No monthly premiums or insurance paperwork

- Immediate access to funds

- Covers everything including routine care

- Money remains yours if unused

Cons:

- Vulnerable early years before adequate savings build

- Temptation to spend on non-pet expenses

- No protection against catastrophic costs exceeding savings

- Requires financial discipline to maintain contributions

- Inflation erodes purchasing power over time

- Large emergencies can completely drain the account

Real-Life Examples and Case Studies

Case Study 1: Max the Golden Retriever

Max swallowed a toy sock, requiring emergency intestinal surgery. Total bill: $6,000. His owner’s pet insurance covered 90% after a $250 deductible, leaving them with just $850 out-of-pocket. Without insurance, they would have faced the full $6,000 bill—more than most people have in their emergency savings.

Case Study 2: Cody the Domestic Shorthair

Cody broke his femur jumping onto a bed, requiring a femoral head ostectomy. Total cost: $3,780. Pet insurance reimbursed $2,780, saving his owner significant financial stress during an already traumatic time.

Case Study 3: Rory the Boxer Mix

When Rory was diagnosed with lymphoma, his treatment costs topped $8,625. His owner, who paid approximately $350 annually for insurance, received $6,898 in reimbursements. He called it “one of the best investments I’ve made”.

Case Study 4: The Sock Surgery Scenario

Consider two timing scenarios for the same emergency:

- Early detection: Dog ate sock minutes ago, needs induced vomiting and monitoring—$300-$800

- Late detection: Sock causes intestinal blockage requiring surgery—$3,000-$6,000+

This demonstrates how quickly costs can escalate, making insurance coverage particularly valuable for worst-case scenarios.

What Financial Experts Recommend in 2025

Financial experts increasingly favor pet insurance in today’s economic climate. Ricky Walther, Chief Medical Officer at Pawlicy Advisor, notes that discretionary income is shrinking for pet owners nationwide, making predictable insurance premiums more manageable than surprise five-figure veterinary bills.

The 20-29% year-over-year growth in pet insurance adoption reflects growing consumer awareness that veterinary inflation consistently outpaces general economic inflation. With emergency vet visits now starting at $300-$400 in major cities before any treatment begins, the financial risk has never been higher.

Key expert insights for 2025:

- Veterinary costs are rising faster than wages, making large emergency bills increasingly unaffordable

- Pet insurance acts as a financial hedge against unpredictable, high-cost medical events

- Early enrollment is crucial before health issues develop into pre-existing conditions

- The emotional value of pets drives owners to seek the best care regardless of cost, making financial protection essential

If you’re leaning toward a savings-only approach, consider the rising cost of unexpected emergencies. Learn what accident-only pet insurance actually covers.

Hybrid Option: Can You Do Both?

Many financial advisors recommend a combination approach: carry pet insurance for major medical expenses while maintaining a smaller savings account for routine care and uncovered items.

Suggested hybrid strategy:

- Pet insurance with 80-90% coverage for accidents and illnesses

- $1,000-$2,000 savings account for:

- Deductibles and co-pays

- Routine wellness care

- Prescription foods or supplements

- Grooming and boarding costs

This approach provides comprehensive protection while maintaining financial flexibility. Your insurance handles the big-ticket items that could devastate your budget, while your savings cover predictable expenses and insurance gaps.

Real-world hybrid example:

- Monthly insurance premium: $45

- Monthly savings contribution: $25

- Total monthly pet budget: $70

- Result: Major medical coverage plus $300 annual savings for routine expenses

Conclusion: Which One’s Right for You?

Pet insurance typically offers superior financial protection for most pet owners, particularly those with:

- Young pets without pre-existing conditions

- Purebred animals prone to genetic conditions

- Limited emergency savings (less than $5,000)

- Risk-averse personalities preferring predictable costs

- Strong emotional attachment to their pets (willing to pursue expensive treatments)

A savings account might work better if you:

- Have substantial disposable income to quickly build a large emergency fund

- Own older pets with multiple pre-existing conditions

- Prefer complete control over your money

- Can realistically save $500+ monthly for pet expenses

- Have multiple pets (making individual insurance policies expensive)

The bottom line: With average emergency veterinary bills ranging from $1,500 to $5,000+ and the potential for catastrophic cases exceeding $40,000, pet insurance provides crucial financial protection when you need it most. While a savings account offers flexibility, it requires significant time and discipline to build adequate protection.

For most pet parents, starting with pet insurance and adding savings over time creates the strongest financial safety net. Your pet’s health—and your peace of mind—are worth protecting with a comprehensive approach that shields you from both routine expenses and catastrophic medical bills.

Ready to protect your pet and your wallet? Get a free pet insurance quote today to see how affordable peace of mind can be. Download our pet emergency savings planner to start building your financial safety net, and explore our comprehensive guides to pet insurance providers to find the perfect coverage for your furry family member.

- https://www.petfoodindustry.com/pet-food-market/news/15738447/january-2025-petflation-stable-versus-2024-numbers

- https://www.marketwatch.com/insurance-services/pet-insurance/pet-insurance-cost/

- https://www.carecredit.com/well-u/pet-care/emergency-vet-visit-cost-and-veterinary-financing/

- https://www.rover.com/blog/emergency-vet-cost/

- https://www.rover.com/blog/pet-insurance-versus-savings/