Veterinary costs have surged dramatically over the past decade, with the average cost of a vet bill increasing by over 60%. As pet parents face these rising expenses, many worry they might be overpaying for pet insurance premiums that could double or even triple over their pet’s lifetime. Understanding the true cost of pet insurance in 2025 can help you make informed decisions about protecting your furry family member without breaking the bank.

Average Pet Insurance Costs in 2025

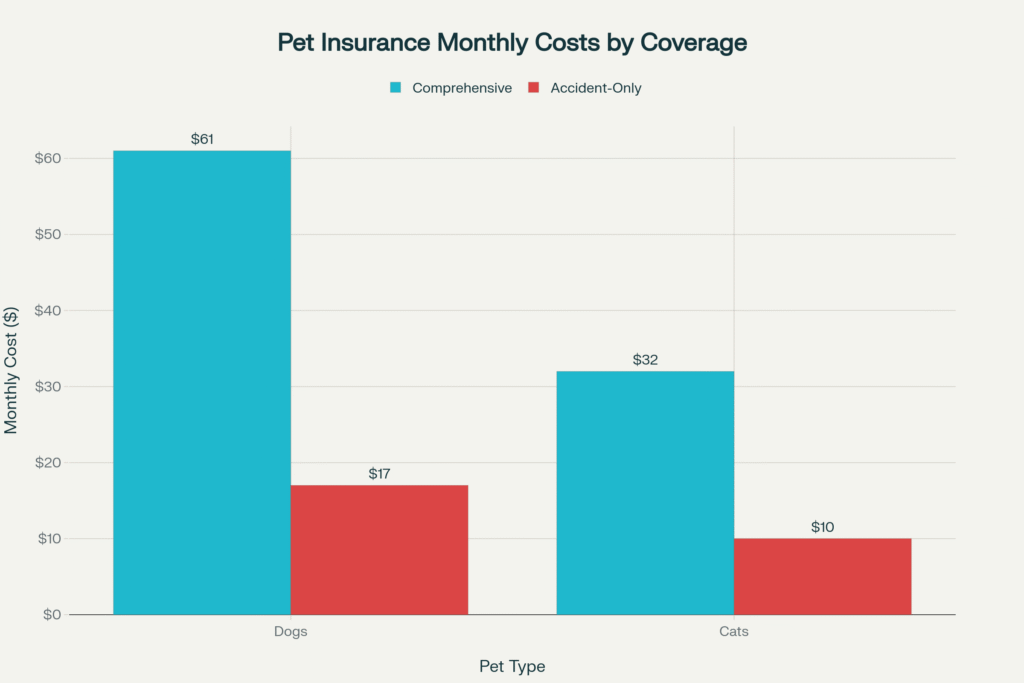

The pet insurance landscape in 2025 shows significant variation in pricing, but current industry data reveals clear benchmarks. The average monthly cost of pet insurance is $62.44 for dogs and $32.21 for cats, according to the North American Pet Health Insurance Association (NAPHIA).

Average Pet Insurance Costs: Dogs vs Cats (2025)

Monthly and Yearly Cost Breakdown

For Dogs:

- Comprehensive coverage: $56-62 per month ($672-744 annually)

- Accident-only coverage: $17 per month ($204 annually)

For Cats:

- Comprehensive coverage: $32 per month ($384 annually)

- Accident-only coverage: $10 per month ($120 annually)

Key Factors Affecting Cost

Several critical factors influence your pet insurance premiums:

Age: Younger pets cost significantly less to insure. The older your pet gets, the more expensive premiums become. Insurers often implement substantial rate increases when pets reach age 8-10.

Breed: Certain breeds are more expensive due to genetic predispositions. French Bulldogs average $92 per month, while Goldendoodles cost around $44 monthly. Large breeds like German Shepherds and Great Danes face higher premiums due to increased likelihood of joint issues and shorter lifespans.

Location: Geographic location significantly impacts costs. Urban areas like New York City command higher premiums than rural locations due to increased veterinary costs.

Coverage Type: Comprehensive accident and illness plans cost 3-6 times more than accident-only coverage, but provide vastly broader protection.

👉 Want to save more on vet bills? Check out how smart pet gadgets in 2025 are helping pet parents monitor health, prevent emergencies, and lower insurance costs.

Cost Comparison—Dogs vs Cats

Dogs consistently cost more to insure than cats across all coverage types. This disparity stems from dogs being more adventurous and injury-prone, with two-thirds of pet injuries occurring in dogs. Additionally, 63% of American cats are kept exclusively indoors, reducing their exposure to accidents and illnesses.

Breed-Specific Pricing Examples

Popular Dog Breeds (Monthly Averages):

- French Bulldog: $92

- Labrador Retriever: $62

- Pit Bull: $59

- German Shepherd: $57

- Goldendoodle: $44

Popular Cat Breeds (Monthly Averages):

- Abyssinian: $30

- Maine Coon: $31

- British Shorthair: $31

- Persian: $31

- Ragdoll: $27

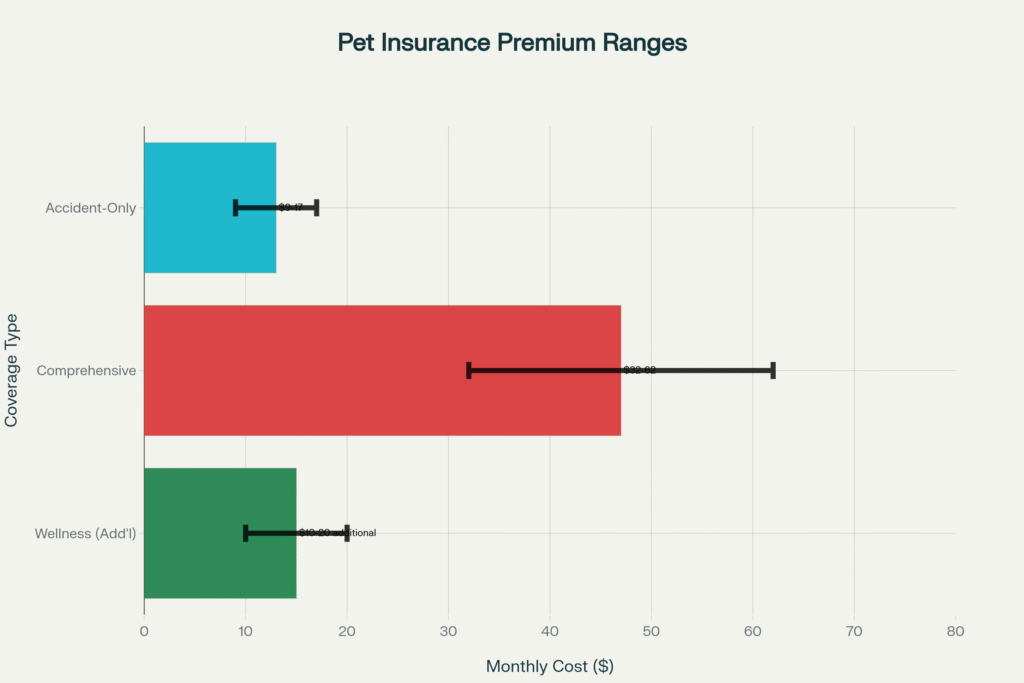

Types of Coverage & Price Differences

Understanding different coverage tiers helps you choose appropriate protection without overpaying for unnecessary features.

Pet Insurance Coverage Types & Costs (2025)

Coverage Options Explained

Accident-Only Plans cover injuries from accidents, poisoning, fractures, and bite wounds. These basic plans are ideal for healthy young pets and budget-conscious owners.

Comprehensive (Accident + Illness) plans cover accidents plus illnesses, chronic conditions, cancer, infections, and hereditary issues. Annual costs average $640 for dogs and $387 for cats.

Wellness Add-Ons provide coverage for routine care including annual exams, vaccinations, dental cleanings, and spay/neuter procedures. These typically cost an additional $10-20 per month.

How to Tell If You’re Overpaying

Several red flags indicate you might be paying too much for pet insurance:

Warning Signs of Overpriced Coverage

Premium Increases Exceeding 100%: If your premiums have doubled or more within 2-3 years without major claims, you may be overpaying. Some owners report increases from $300 to over $1,300 annually.

Poor Claims Reimbursement: If you consistently pay more in premiums than you receive back in claims over multiple years, evaluate whether the coverage justifies the cost.

Excessive Exclusions: Policies with extensive breed-specific exclusions, pre-existing condition limitations, or per-condition deductibles may offer poor value.

2025 Fair Price Benchmarks

Based on industry data, fair pricing guidelines include:

- Dogs under 5 years: $40-70/month for comprehensive coverage

- Cats under 5 years: $25-35/month for comprehensive coverage

- Accident-only: Under $20/month for dogs, under $12/month for cats

If your premiums significantly exceed these ranges without justification, consider shopping for alternatives.

Tips to Save on Pet Insurance in 2025

Discount Opportunities

Multi-Pet Discounts: Most insurers offer 5-10% discounts when insuring multiple pets, with some providing up to 10% off additional pets.

Professional Discounts: Military members, veterans, and first responders often qualify for 10% discounts.

Higher Deductibles: Choosing annual deductibles of $500-1,000 instead of $250 can reduce monthly premiums by 15-25%.

Strategic Enrollment Tips

Enroll Early: Insuring pets as puppies or kittens locks in lower rates and avoids pre-existing condition exclusions.

Annual vs Monthly Payments: Some insurers offer discounts for paying annually instead of monthly.

Employer Group Benefits: Check if your employer offers group pet insurance rates, which can provide significant savings.

Smart Alternatives: Technology-Driven Solutions

The pet insurance industry is evolving with innovative technology that may reduce traditional premium costs:

AI-Powered Health Monitoring

Smart Collars and Wearables: Devices like SATELLAI Collar and PetPace Health 2.0 use AI to monitor vital signs, activity levels, and early disease detection. These tools can help catch issues early, potentially reducing claim costs.

💡 Did you know that smart collars can actually reduce your monthly premiums? Learn how pet insurers reward tech-savvy pet parents in our 2025 guide.

Smart Collars Are Cutting Pet Insurance Premiums in Half – Here’s How (2025 Guide)

Satellite-Enabled Tracking: New satellite communication technology ensures location tracking even in remote areas, reducing the risk of lost pets and associated search costs.

Telemedicine Integration

24/7 Veterinary Consultations: Some insurers now offer telehealth services included in premiums, providing immediate access to veterinary advice without emergency room visits.

Preventive Care Apps: AI-powered apps provide medication reminders, health tracking, and early warning systems that can prevent minor issues from becoming major expenses.

Subscription-Based Models

Alternative Payment Structures: Some companies offer non-insurance alternatives like QubeHealth-Pay, providing credit lines up to ₹10 lakh for pet healthcare at discounted rates.

Usage-Based Pricing: Wearable technology enables insurers to offer discounts for pets whose owners pursue preventative care, similar to safe driving discounts in auto insurance.

The pet insurance market is projected to grow from $11.4 billion in 2025 to $50.8 billion by 2035, driven largely by technological integration and personalized coverage options. These innovations may help contain premium growth while improving care quality.

key Takeaway: While pet insurance costs have risen significantly, understanding fair market pricing and available discounts can help you secure appropriate coverage without overpaying. Focus on comprehensive coverage for young pets, consider accident-only plans for healthy animals, and explore technology-integrated solutions that may offer better value. Remember that the cheapest policy isn’t always the best value—prioritize coverage that matches your pet’s specific needs and your financial situation.