As a devoted dog parent, there’s nothing more heartbreaking than watching your furry family member suffer—and nothing more stressful than receiving a massive vet bill when they need emergency care. In 2025, the reality is stark: veterinary costs have surged by over 60% in the past decade, with emergency visits now costing up to $5,000 or more. The average monthly cost of pet insurance is now $62 for dogs, but this small investment can save you thousands when your beloved companion needs critical care.

Pet insurance has evolved from a luxury to a necessity, with over 6.4 million pets now covered in the United States. The industry is experiencing unprecedented growth, with premiums reaching a record $1.31 billion in Q1 2025 alone. This comprehensive guide will walk you through the top 7 pet insurance plans available right now, helping you make an informed decision that protects both your dog’s health and your financial peace of mind.

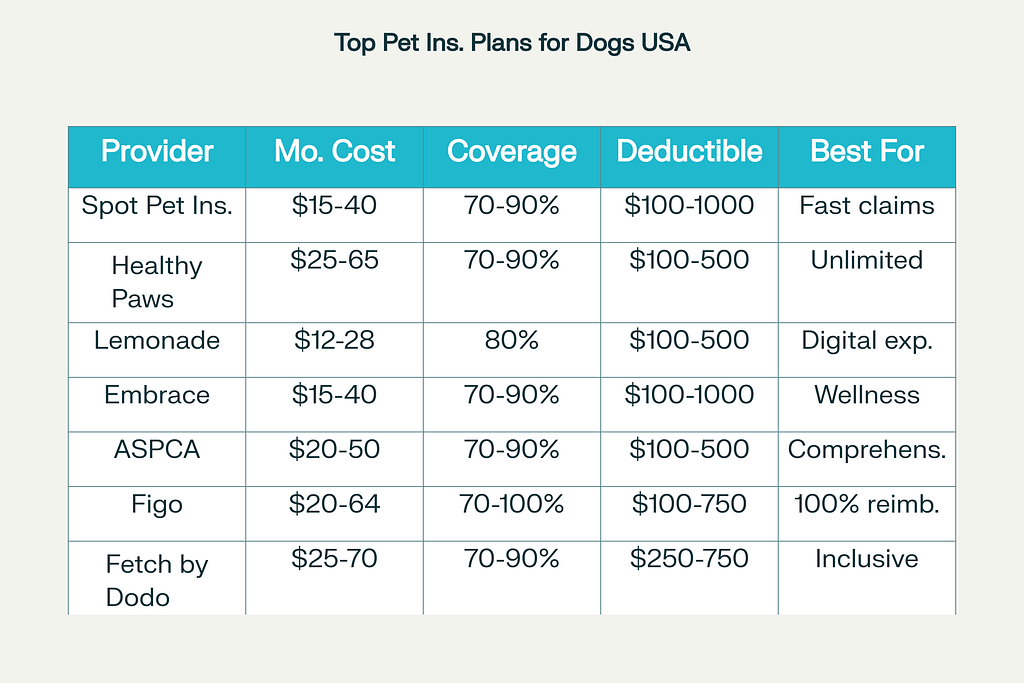

Quick Comparison of the 7 Best Plans

Individual Reviews

Spot Pet Insurance

Pricing: Plans start as low as $15 per month and can range up to $40 monthly depending on your coverage choices. Sample pricing shows accident and illness coverage with 80% reimbursement ranging from $20-40 monthly for a 2-year-old Cairn Terrier mix.

Coverage: Spot offers comprehensive accident and illness coverage including diagnostics, treatments, surgeries, prescription medications, behavioral issues, hereditary conditions, and dental illnesses. They cover up to 90% of eligible vet bills with annual limits ranging from $2,500 to unlimited.

Deductibles: Choose from $100, $250, $500, $750, or $1,000 annual deductibles.

Exclusions: Pre-existing conditions, cosmetic procedures, and breeding-related costs are not covered.

Pros:

- Fast claim processing with most reimbursements within 2 days

- 30-day money-back guarantee

- Multi-pet discounts available

- 24/7 vet helpline access

- No upper age limits for enrollment

Cons:

Customer Reviews: Spot maintains a 4.7/5 rating based on over 8,800 reviews, with customers praising the “seamless” claims process and quick reimbursements. One reviewer noted: “Spot covered more than I thought they would. I was expecting a run around with each submitted claim, but it was pretty seamless”.

Why It’s Great: Spot excels in claim processing speed and customer satisfaction, making it ideal for pet parents who want reliable, straightforward coverage without complexity.

Healthy Paws

Pricing: Monthly premiums typically range from $25-65 for most dogs, with the national average around $60. Costs vary significantly based on your pet’s age, breed, and location.

Coverage: Healthy Paws offers one comprehensive plan covering accidents, illnesses, cancer, emergency care, genetic conditions, hereditary conditions, and alternative treatments. The plan provides unlimited annual and lifetime payouts with no caps.

Deductibles: Annual deductibles range from $100 to $500.

Exclusions: Exam fees, routine care, behavioral modifications, and pre-existing conditions are not covered. Pets over 6 years old have limited coverage options.

Pros:

- Unlimited lifetime coverage with no caps

- Fast claim processing—most within 2 days

- Option for direct payment to veterinarians

- Covers hereditary and congenital conditions

- High customer satisfaction ratings

Cons:

- No exam fee coverage

- Limited customization options

- Coverage restrictions for senior pets

- Premium increases as pets age

Customer Reviews: Customers appreciate the comprehensive coverage and fast claim processing. One reviewer shared: “Healthy Paws addresses many of your concerns. The claim submission process is straightforward, and they respond quickly”.

Why It’s Great: Perfect for pet parents seeking unlimited coverage and rapid claim processing, especially for younger to middle-aged dogs.

Lemonade

Pricing: Among the most affordable options, with plans starting from $12-15 monthly. Young cats start around $16-18 monthly, while small breed dogs average $25-30 monthly.

Coverage: Lemonade offers a single customizable plan with 80% reimbursement (70%, 80%, or 90% available), covering accidents, illnesses, diagnostics, surgery, and prescription medications. Annual limits range from $5,000 to $100,000.

Deductibles: Choose from $100, $250, $500, or $750 annual deductibles.

Exclusions: Exam fees (unless purchased as add-on), dental illness (unless add-on purchased), behavioral conditions, and pre-existing conditions are excluded.

Pros:

- Highly affordable premiums

- Fully digital experience with AI-powered claims

- Fast claim processing—most within 1-3 days

- Multi-pet and bundle discounts available

- Charitable giving focus

Cons:

- Limited customization in base plan

- Exam fees require additional purchase

- No 24/7 vet helpline in base plan

- Wellness coverage costs extra

Customer Reviews: Lemonade maintains a 4.1/5 Trustpilot rating, with customers praising the user-friendly app and fast digital processes.

Why It’s Great: Ideal for tech-savvy pet parents seeking affordable, streamlined coverage with a digital-first approach.

Embrace

Pricing: Monthly costs typically range from $15-40 for most dogs and $15-20 for cats. The company offers competitive pricing with various cost-saving options.

Deductibles: Options include $100, $300, $500, $750, or $1,000 annually, with a unique “diminishing deductible” that reduces by $50 each claim-free year.

Coverage: Comprehensive accident and illness coverage including dental illness, behavioral therapy, alternative treatments, and prescription medications. Annual limits range from $5,000 to unlimited.

Exclusions: Pre-existing conditions, routine care (unless wellness plan purchased), and cosmetic procedures are excluded.

Pros:

- Diminishing deductible feature

- Comprehensive coverage including behavioral therapy

- Multiple discount options (military, multi-pet, employee benefits)

- Wellness Rewards program available

- Excellent customer satisfaction

Cons:

- 6-month orthopedic waiting period for dogs

- Annual premium increases

- $25 enrollment fee and $1 monthly processing fee

Customer Reviews: Embrace earns high marks with a 4.6/5 star rating, praised for comprehensive coverage and customer service.

Why It’s Great: Perfect for pet parents who want comprehensive coverage with unique cost-saving features like the diminishing deductible.

ASPCA Pet Health Insurance

Pricing: Monthly premiums typically range from $20-50 depending on coverage options chosen. The company offers competitive rates with unlimited annual coverage options.

Coverage: ASPCA provides some of the most comprehensive coverage in the industry, including exam fees, alternative therapies, behavioral issues, congenital conditions, prescription food/supplements for covered conditions, and dental illness.

Deductibles: Choose from $100, $250, or $500 annual deductibles.

Exclusions: Pre-existing conditions, cosmetic procedures, and breeding-related expenses are excluded.

Pros:

- Extremely comprehensive coverage

- Covers exam fees in base plan

- No upper age limits for accident-only plans

- 10% multi-pet discount

- Covers horses in addition to cats and dogs

- Shorter cruciate ligament waiting period (14 days vs. competitors’ 6-12 months)

Cons:

- Mixed customer service experiences

- Some customers report claim denials

- Must call for unlimited coverage quotes

Customer Reviews: ASPCA maintains a 3.7/5 Trustpilot rating with mixed reviews. Positive experiences highlight reasonable monthly payments and quick payouts, while negative reviews focus on claim denials and customer service issues.

Why It’s Great: Best for pet parents seeking the most comprehensive coverage available, especially those with senior pets or multiple animals.

Figo

Pricing: Monthly costs range from $20-64, positioning Figo in the mid-range pricing tier. The company offers competitive rates with flexible plan options.

Coverage: Figo offers three plan tiers (Popular, Higher Coverage, Value Plus) covering accidents, illnesses, cancer, hereditary conditions, alternative treatments, and dental illness. Reimbursement rates go up to 100% for plans with deductibles over $500.

Deductibles: Choose from $100, $250, $500, or $750 annually, with a unique decreasing deductible that reduces $50 each claim-free year.

Exclusions: Pre-existing conditions, experimental procedures, breeding costs, and cosmetic surgery are excluded.

Pros:

- Up to 100% reimbursement available

- Unlimited annual coverage options

- Fast claim processing—most in under 3 days

- Coverage for curable pre-existing conditions after 12 months symptom-free

- 24/7 live vet access included

Cons:

Customer Reviews: Figo maintains strong customer satisfaction with reviews highlighting fast claim processing and helpful customer service.

Why It’s Great: Ideal for pet parents seeking maximum reimbursement rates and unlimited coverage with comprehensive benefits.

Fetch by The Dodo

Pricing: Monthly premiums typically range from $25-70, making it one of the higher-priced options. However, customers report that premiums can increase significantly each year.

Coverage: Fetch provides all-inclusive coverage including virtual vet visits, behavioral treatments, alternative medicine, emergency boarding, advanced dental treatments, and exam fees in the base plan. Coverage is available for pets as young as 6 weeks.

Deductibles: Options typically range from $250-750 annually.

Exclusions: Pre-existing conditions and cosmetic procedures are excluded.

Pros:

- Most comprehensive coverage available

- Includes exam fees in base plan

- Covers virtual vet visits and behavioral treatments

- Emergency vacation cancellation reimbursement

- Military discounts available

- Strong customer service ratings

Cons:

- Higher monthly premiums

- Significant annual premium increases reported

- Limited plan customization options

- Some customers report claim denial issues

Customer Reviews: Fetch maintains a 4.5/5 Trustpilot rating with over 5,000 reviews. Customers praise comprehensive coverage and customer service, but some express frustration with premium increases and claim denials.

Why It’s Great: Best for pet parents who want the most comprehensive coverage available and don’t mind paying premium prices for extensive benefits.

How to Choose the Best Plan Based on Your Dog’s Profile

For Young Dogs (Under 3 Years):

Consider Lemonade or Spot for affordable premiums with solid coverage. Young dogs have fewer pre-existing conditions and benefit from early enrollment.

For Senior Dogs (7+ Years):

ASPCA or Embrace offer the best options for older pets, with ASPCA having no age limits for accident coverage and Embrace providing comprehensive chronic condition coverage.

For Large Breeds:

Choose plans with unlimited annual limits like Healthy Paws or Figo, as large breeds are prone to expensive orthopedic issues.

For Budget-Conscious Owners:

Lemonade offers the most affordable premiums starting at $12-15 monthly, while still providing solid basic coverage.

For Maximum Coverage:

Fetch or ASPCA provide the most comprehensive coverage, including exam fees, behavioral therapy, and alternative treatments.

Call-to-Action

Ready to protect your furry family member? Don’t wait until it’s too late—emergency vet bills can cost thousands, but pet insurance premiums start at just $12 per month. Compare quotes from multiple providers to find the perfect plan for your dog’s unique needs and your budget.

Bookmark FurSurely.com for the latest pet insurance advice, reviews, and money-saving tips. We’re here to help you navigate the world of pet insurance with confidence and make informed decisions that keep both your dog and your wallet healthy.

For detailed information about coverage percentages and what you can expect from your policy, check out our comprehensive guide: How Much of Your Vet Bill Does Pet Insurance Really Cover?

FAQs

What is the best pet insurance in the USA in 2025?

The “best” pet insurance depends on your specific needs, but our top recommendations are:

- Overall Best: Healthy Paws for unlimited coverage and fast processing

- Best Value: Lemonade for affordable, digital-first coverage

- Best for Comprehensive Coverage: ASPCA for the most inclusive benefits

- Best for Seniors: Embrace for older dogs with chronic conditions

Is pet insurance worth it for senior dogs?

Yes, pet insurance can be especially valuable for senior dogs. While premiums are higher for older pets, they’re also more likely to develop expensive chronic conditions like diabetes, heart disease, or cancer. ASPCA and Embrace offer the best coverage options for senior pets, with ASPCA providing accident-only coverage regardless of age.

Does pet insurance cover dental and routine care?

Most basic pet insurance plans do not cover routine dental cleanings or preventive care. However: